On Monday, 29 July, the World Bank announced that it does not plan to offer new financing to Sri Lanka until the country has an adequate macroeconomic policy framework in place.

In a statement, the World Bank said Sri Lanka needed to adopt structural reforms that focus on economic stabilisation and tackle the root causes of its crisis, which has starved it of foreign exchange and led to shortages of food, fuel and medicines.

“The World Bank Group is deeply concerned about the dire economic situation and its impact on the people of Sri Lanka,” it said.

What Is A Macroeconomic Policy Framework?

A macroeconomic policy is concerned with how a country’s economy operates as a whole: it’s the basic gameplan of how to run and manage a nation’s economy.

The goal of this framework, broadly speaking, is to provide a stable economic environment that fosters strong and sustainable economic growth, where jobs are created, and wealth and living standards are improved – none of which is happening in Sri Lanka at the moment.

The Sri Lanka-World Bank’s relationship spans over six decades. Over the years the World Bank has provided financial support to Sri Lanka in order to assist the country meet its development goals.

The reason the World Bank is reluctant to offer new financial aid is probably due to the uncertain nature of Sri Lanka’s economy. After defaulting on its foreign debt and going through massive political unrest, the country’s economy — as President Ranil Wickremesinghe has said — has collapsed. Therefore, it is no surprise that an international lender is hesitant to offer more help.

How Many Projects Has the World Bank Financed?

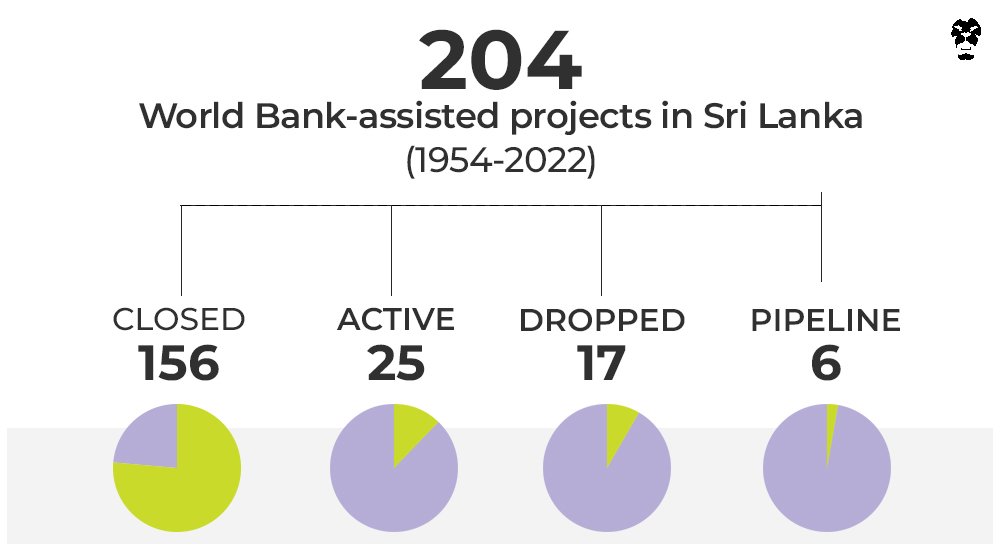

In June, ousted President Gotabaya Rajapaksa said that the World Bank would restructure 17 existing projects in Sri Lanka. More assistance was expected after negotiations with the International Monetary Fund on a financing loan.

The 17 World Bank projects are out of the 25 currently active projects in the country. Accordingly, around USD 160 million allocated to these World Bank projects will be restructured to alleviate shortages in medicine, cooking gas, fertiliser, meals for school children, and cash transfers for poor and vulnerable households.

During its 68-year presence relationship, the World Bank has financed 204 projects in Sri Lanka, of which 156 projects are completed and six are currently in the pipeline.

The Aberdeen Laksapana Hydroelectric Project in July 1954 was the first project financed by the World Bank. The USD 19.1 million commitment went into expanding the hydroelectric generation and the construction of a storage dam on the Kehelgamu river.

How Does The World Bank Finance Projects?

The World Bank finances projects with their partnering countries using multiple types of financing methods.

- Grants: These are given to civil society organisations. Sri Lanka has received 12 grants so far.

- IBRD loans: International Bank For Reconstruction And Development (IBRD) is one of the two main bodies of the World Bank. IBRD Flexible Loans are the leading loan plans of the World Bank for borrowers. Sri Lanka has received 14 IBRD loans so far.

- IDA loans: Loans and borrowings from the International Development Association (IDA), the second main member of the World Bank. It offers concessional loans and grants to developing countries. Sri Lanka has received 84 IDA loans so far.

How Has The World Bank Helped Sri Lanka Recently?

In 2020, the World Bank was the second largest external lender to the country, with USD 217.8 million.

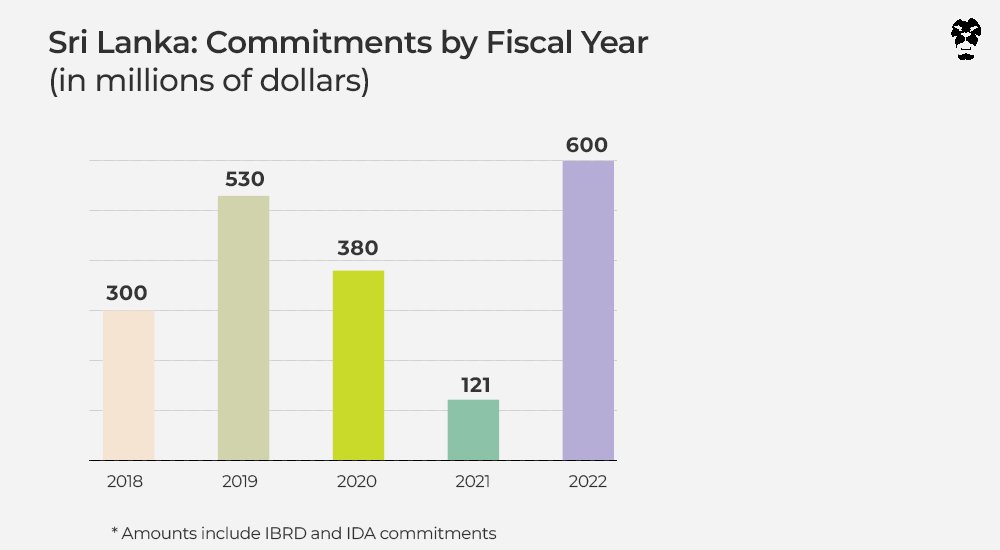

By the end of 2021, Sri Lanka owed USD 3631.2 million in outstanding debt to the World Bank. In May 2022, another USD 600 million was to be given to the country by repurposing its existing loans, considering the early stages of its economic collapse.

This money was accordingly spent on payment requirements for essential imports earlier this year.

.jpg?w=600)

.jpg?w=600)