Sri Lankan companies have it tough in March. It is the month during which the financial year normally ends, and the result is a constant merry-go-round of audits, budgets, and variance analyses.

And since it is earnings season, March also keeps investors on their toes much more than usual. Transaction volumes tend to pick up as investors pore over annual reports trying to find the next gem, while others may eagerly await their dividend payments. All in all, it is a pretty interesting time to be invested in the stock market.

Let’s have a look at how the Colombo Stock Exchange fared in March. Read on!

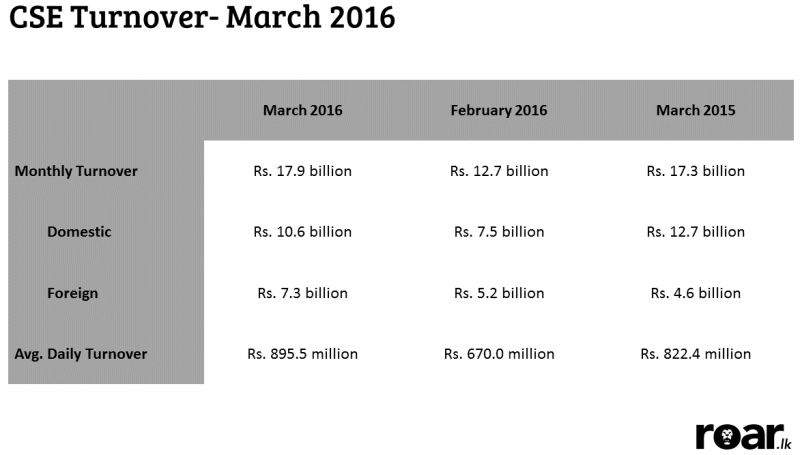

- As expected, the monthly turnover picked up to Rs. 17.9 billion, compared to Rs. 12.7 billion in February. In fact, this is normal behaviour for any stock market.

Table 1

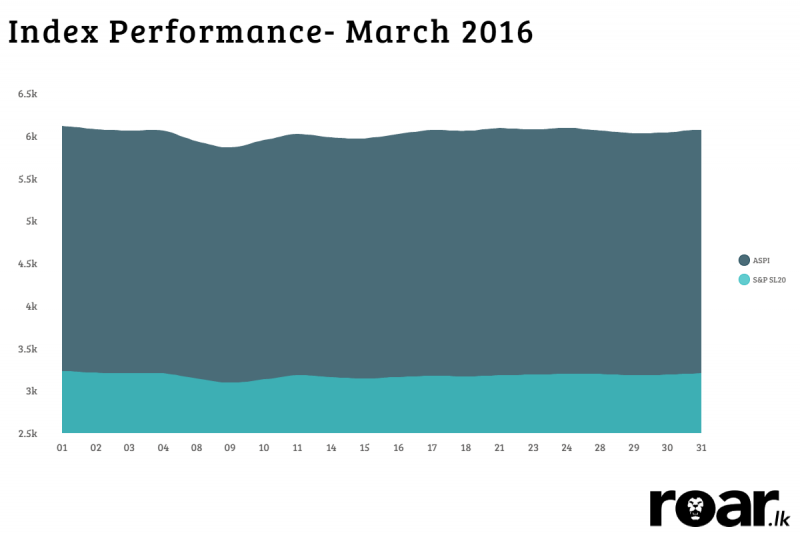

- Due to the constant see-sawing that can be witnessed during earnings season, the declines in both indices were marginal. The ASPI fell by 1.94%, and the S&P fell by 1.39%. Consequently, the market’s Price/Earnings Ratio stood at 15.29x as at the end of March.

CSE Index Performance, March 2016

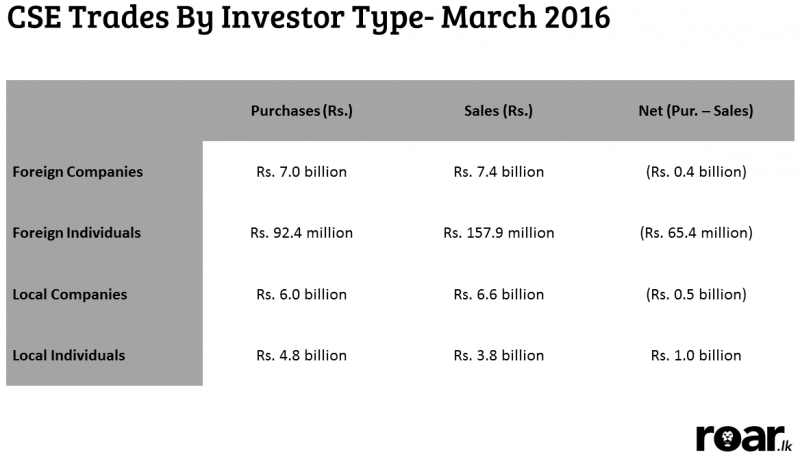

- Except for local individual investors, everyone else decided to cash out in March (on a net basis). A lot of it has to do with the bad news surrounding the economy, and rising interest rates. However, things should brighten up if the Government manages to strike a deal with the IMF.

Table 2

So there you go. We’ve already sped past the first quarter of 2016. Time flies, doesn’t it?

Also, do watch out for next month’s edition, where we’ll talk about the CSE adopting the Global Industry Classification Standard or GICS, among other things.

Till next time!

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Always seek independent advice.

Cover image courtesy: forbes.com